Breadth and Reach of Blueberry Sales Continue to Expand

Twenty years ago world blueberry production reached 50 million pounds, causing the industry to stand back in awe and wonder what it was going to do with all that fruit.

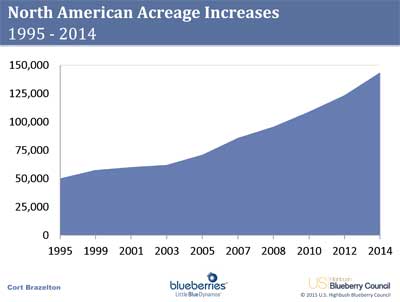

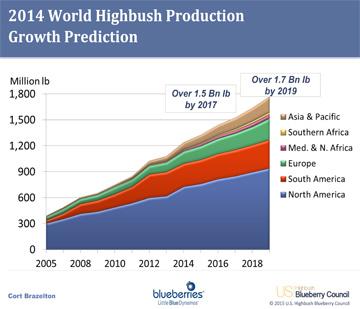

Flash forward to today and the industry is producing 1.2 billion pounds, twenty-four times more than in 1995.

“We are now clearly the number two berry, behind strawberries,” said Dave Brazelton of Fall Creek Farm & Nursery during a presentation at the 2016 Oregon Blueberry Conference, January 25 in Portland.

And, he added, despite a better shelf life and other factors favoring strawberries, many expect blueberries to eventually claim the number one berry spot.

While strawberry consumption has essentially doubled in the last twenty years, going from 5.7 billion pounds to 10 billion, that growth rate pales in comparison to the growth rate of blueberries. While strawberry consumption has essentially doubled in the last twenty years, going from 5.7 billion pounds to 10 billion, that growth rate pales in comparison to the growth rate of blueberries.

Looking solely at the West, highbush blueberry production has increased from 213 million pounds in 2010 to 374.5 million in 2014. Acres in blueberry production, meanwhile, has doubled in recent years, increasing from 30,000 acres in 2007 to 58,000 in 2014.

Acreage in the Midwest has increased at a much slower rate, going from 21,425 in 2007 to 25,070 in 2014, with Midwest production increasing from 83.7 million pounds in 2012 to 95.3 million in 2014.

In the Northeast, a similar trend can be seen, although the numbers are much smaller. Acres in blueberries increased from 10,400 in 2007 to 12,000 in 2014.

In the Southern Region, acres more than doubled in the last eight years, increasing from 22,300 in 2007 to 49,990 in 2014. Georgia is responsible for much of that growth, going from 9,120 acres in 2007 to 23,500 acres in 2014.

Outside of the U.S., extensive blueberry growth is occurring in Mexico and Guatemala. Combined, blueberry acres in the two countries have increased from just 545 in 2007 to 6,391 in 2014. Most of that acreage is under tunnels, Brazelton said.

“This area is growing rapidly,” Brazelton said. “And the significance of that is Mexico will steadily gain market share for counter-seasonal production. “This area is growing rapidly,” Brazelton said. “And the significance of that is Mexico will steadily gain market share for counter-seasonal production.

“They’ll produce more and more getting into as late as May,” he said.

One blueberry expert, Brazelton noted, has predicted that within ten years, North America will be self-sufficient in its fresh berry crop. Just between 2010 and 2014, total North American production grew from 491 million pounds to 727.8 million pounds.

“That is just tremendous growth in this area,” Bazelton said. “It is amazing what we’ve done.”

Acres in blueberries in North American have increased from 52,000 in 1995 to 140,000 in 2014.

“What happened in 1995 is the antioxidant message took off,” Brazelton said, “and blueberries came out highest in antioxidants on a list of berries.”

Brazelton identified the export market as the greatest opportunity for U.S. blueberry producers. He identified the biggest concern going forward as labor.

“Labor remains the biggest concern,” he said. “We are highly efficient in our processing, but we have a long way to go from mechanizing fresh.”

Another concern Brazelton identified was underperformance among growers new to the industry.

“Rapid growth can lead to underperformance,” he said. “You get this tipping point, particularly when non-growers get into blueberries. You get a shortage of technically efficient people. Decisions are made on crops, on plantings, on design and these acres oftentimes underperform.

“It happened in Argentina,” he said. “We are going to see it in Chile. And I believe we will see it in Georgia and China.

“This is a trend we see around the world in blueberries, because blueberries are hard to grow.”

|